Science suggests that as the climate warms, we can expect hurricanes to hang around longer, dump more rain, and exact increased storm surge damage due to higher sea levels. Using the lens of our DeltaTerra Klima® framework, this analysis measures real estate capital market risks from Hurricane Ian.

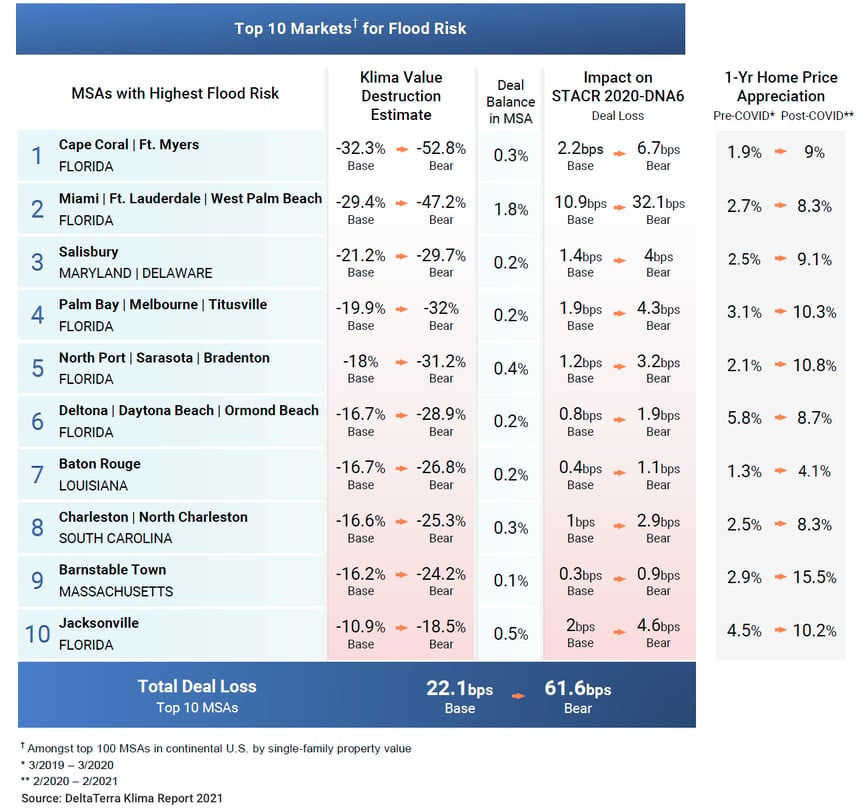

In our DeltaTerra Klima Report from May of 2021, we measured the potential valuation impact from a rationalization in ownership cost expectations related to flood protection and losses in the top 100 metropolitan areas by single-family property value within the contiguous United States. Taking into account 1) scientific estimates of flooding risk in each home market, 2) estimates of current insurance insufficiencies in the market, and 3) estimates of a typical market risk premia response to increasing ownership cost uncertainty, we generated two market correction scenarios in a rationalization. In terms of risk to a repricing of flood protection costs, a metropolitan area along Florida’s Gulf Coast known as Cape Coral-Fort Myers (or Lee County) topped the list.

Below is a screenshot of the DeltaTerra Klima Maps tool that visualizes how our asset overvaluation estimates are distributed across Florida by census tract. Cape Coral-Fort Meyers is the selected metropolitan statistical area (MSA). The metro areas to the north and south of Cape Coral-Fort Myers MSA (Punta Gorda and Naples-Immokalee-Marco Island, respectively) exhibited even greater depreciation risk in our research but weren’t large enough to make the top 100 list. The three metro areas taken together are home to approximately 49K mortgages ($10.3B in principal) that stand behind government issued mortgage credit risk transfer (CRT) bonds. This represents .53% of all such mortgages; a decent proxy for the US mortgage market as a whole.

As Ian mounts an increasingly challenging outcome, Lee County's financial resiliency, and perhaps all of Florida given the systemic codependencies, will be tested in the months and years that follow. See below current predictions from NOAA on the most damaging aspects of this storm: storm surge, wind, and heavy precipitation.

Storm surge:

Wind:

Rain:

________________________________________

We used data from LightBox and the First Street Foundation to sort homes in Lee County and in Florida as a whole into categories of flood zone designation and risk level as shown in the table below. We also included the count of single-family NFIP policies in each region for 2020. While it is impossible to connect specific policies with homes, the data suggests that there are perhaps 30K uninsured high-risk homes in Lee County and more than 150K across the state.

In many recent disaster events, a combination of insurance payouts, government assistance, homeowner contributions, and (importantly) speculative real estate buyers have shouldered damage costs. As a result, mortgage pools in affected regions experienced short-lived delinquency spikes and low realized losses. However, we have recently undergone dramatic changes to the insurance pricing landscape due to NFIP’s Risk Rating 2.0 initiative, as well as significant problems in Florida’s Homeowners Insurance market. Some of the assumptions that supported persistently strong housing markets following disasters in the past may be coming into question.

It remains to be seen whether this storm will lead to the ownership cost rationalization that we are concerned about in Florida, but the risk should be considered material from a systemic perspective. 6.5% of agency mortgage loans standing behind CRT issued by government agencies ($128B in outstanding principal balances) reside in Florida. We model a 3.6% loss rate on these loans in an orderly market rationalization that looks ahead to a successful human response to the climate crisis. If markets begin to see events like Ian becoming commonplace in a future where limited climate action leads to >2°C of global warming, our models anticipate a loss rate of 12.3% on the Florida agency loan book.

To the CRT investors on our research distribution, give us a shout for detailed deal and tranche level impact estimates and a demo of our interactive exposure mapping tool. Our CMBS module is also ready for beta testing and we look forward to sharing more of our work on commercial real estate market exposures to climate risk, as well as shifting office demand fundamentals, in the coming months.

Published on Sept. 28, 2022.